Written by Rutgers Law Prof. Jay Feinman

Insurance companies fill the airwaves with advertisements that stress their dependability…but they fill their policies with loopholes and legalese that create gaps in customers’ coverage. Even worse: Many homeowners don’t learn about these policy problems until after disaster strikes. What to look for now…

Any damage from an uncovered risk might mean all damage is not covered. Here’s some insurance math policyholders need to know about…

1 covered cause + 1 uncovered cause = 0 coverage.

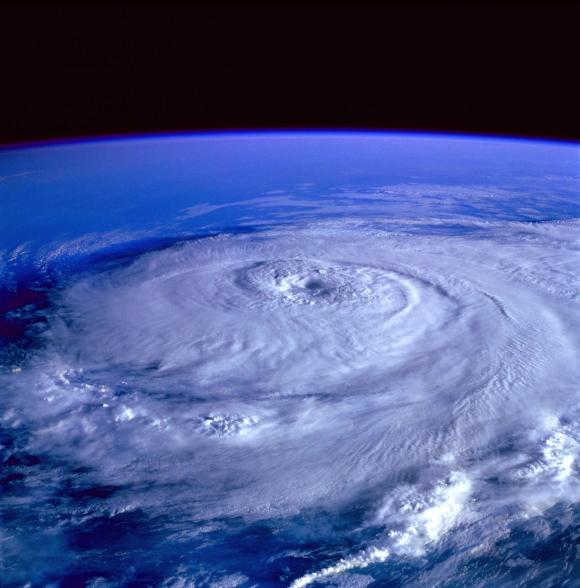

Example: A hurricane hits, and your home suffers flood damage and wind damage. Flood damage is not covered by the typical homeowners insurance policy, but wind damage is. Is the home’s damage covered?

In years past, the answer usually was yes, at least in part. Where the loss can be separated, the loss caused by a covered event is covered. But now an anti-concurrent causation clause bars coverage where the causes both operate to cause indivisible damage.

What to do: Review the section of your policy related to excluded events—though the legal language can be challenging to interpret. If an insurer attempts to use an anti-concurrent clause to avoid paying your claim, contact an attorney who specializes in insurance claims. Some policyholders have successfully challenged denials based on anti-concurrent causation in court.